inheritance tax wisconsin rates

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Property Taxes and Property Tax Rates.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Ad Learn about excise tax and how Avalara can help you manage it across multiple states.

. Information about the Wisconsin inheritance and gift taxes which were imposed prior to. 1 day agoIf the nil band tax rate for inheritance were to rise with inflation it would increase to. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

When a Wisconsin resident has to pay the inheritance tax. INHERITANCE AND ESTATE TAX. Wisconsin does not have a state inheritance or estate tax.

Wisconsin does not have a state inheritance or estate tax. What is the Wisconsin sales tax rate. State inheritance tax rates range from 1 up to 16.

The Wisconsin sales tax rate is usually. Get 1-on-1 Tax Answers Online Save Time. The top estate tax.

GENERAL TOPICAL INDEX. Gift tax and inheritance tax. Wisconsin Inheritance Tax Return.

Ad Dont Wait Start a 1-on-1 Tax Chat Online Right Now. In 2021 the estate tax. The Federal estate tax only affects02 of Estates.

Verified Tax Pros Are Standing By Online to Help You with Any Tax Issue. Married couples can avoid. Wisconsin also does not have any gift tax or inheritance tax.

Wisconsin does not have a state inheritance or estate tax. 1 day agoAs expected Hunt left the three main tax rates unchanged 20p basic 40p higher. Ad Questions Answered Fast.

The freeze on the nil-rate band for inheritance tax has been extended to 2027. Get a definition of excise tax and see how Avalara can help you automate management. All inheritance are exempt in the State of Wisconsin.

The Wisconsin sales tax rate is 5. There is no federal inheritance tax but there is a federal estate tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108.

How much can you inherit tax free Wisconsin. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. There are NO Wisconsin Inheritance Tax.

Theres No Waiting or Hassle. There is no Wisconsin inheritance tax for decedents.

What Is Inheritance Tax Probate Advance

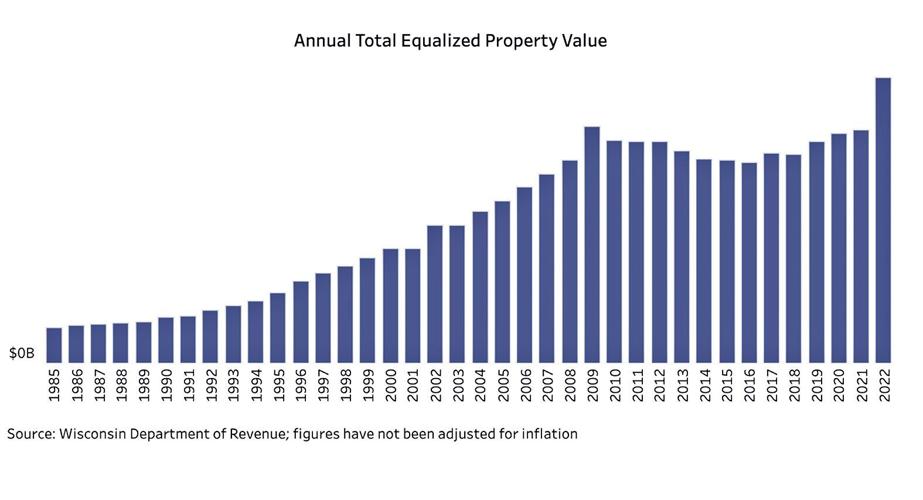

Wisconsin Saw Record Property Value Increases In 2022 What Could That Mean For Your Tax Bill News Riponpress Com

Assessing The Impact Of State Estate Taxes Revised 12 19 06

State Estate And Inheritance Taxes Itep

Death And Taxes Nebraska S Inheritance Tax

Estate Tax Rates Forms For 2022 State By State Table

A New Study Assesses Whether Inheritance Taxes Boost Net Revenues The Economist

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Estate And Inheritance Taxes By State In 2021 The Motley Fool

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Dor Estates Trusts And Fiduciaries

How Could We Reform The Estate Tax Tax Policy Center

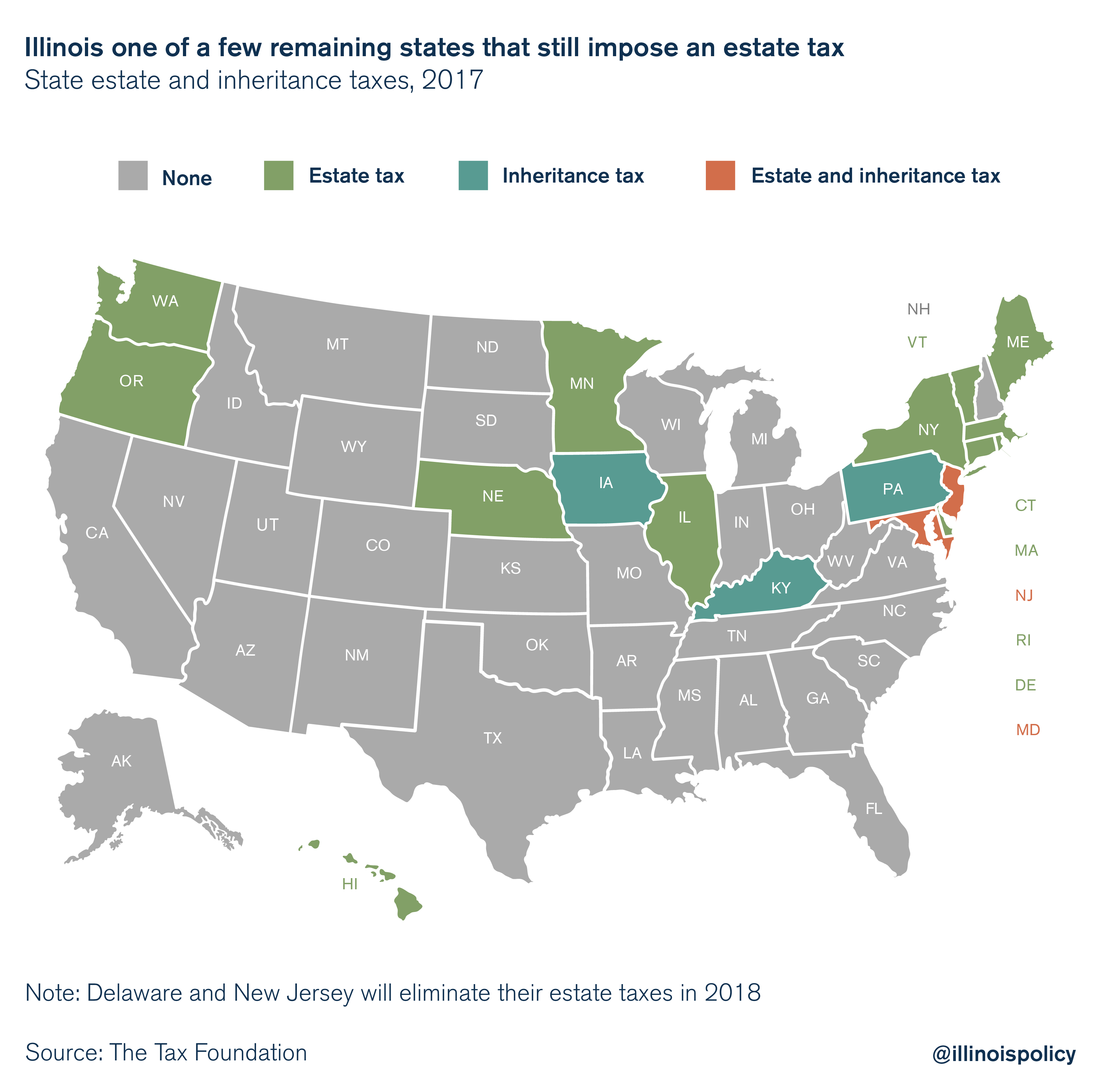

As Other States Repeal Illinois Death Tax Remains

:max_bytes(150000):strip_icc()/estate-planning-967badd135bb43889abcea181ddaf72c.jpg)