pay outstanding excise tax massachusetts

Motor vehicle excise bills are owed to the town where the vehicle was garaged as of January 1. Online Payments Taxes Water Sewer Trash Parking Ticket Appeal Form.

Motor Vehicle Excise Tax Bills Gardner Ma

The excise rate is 25 per 1000 of your vehicles value.

. Tax information for income tax. Ad Access Tax Forms. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

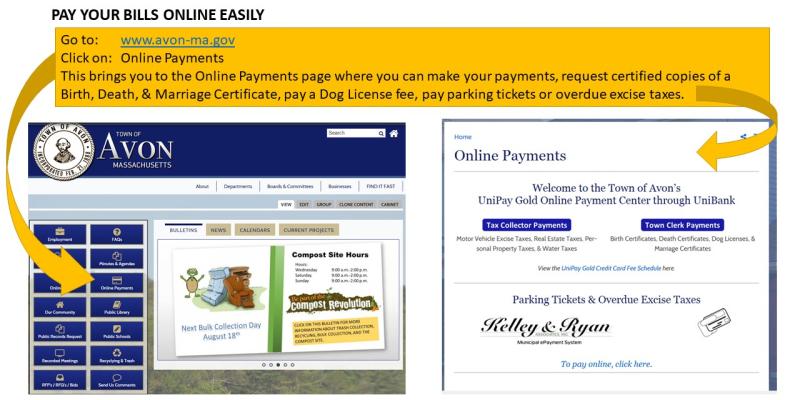

Please note all online payments will have a 45 processing fee added to your total due. All owners of motor vehicles must pay an excise tax therefore it is the responsibility of the owner to contact the Assessors if heshe has not received a bill. Town of Halifax 499 Plymouth Street Halifax MA 02338 Phone.

If your vehicle isnt. Online Payment Search Form. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

781 293-1734 Town Hall Fax. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax. Massachusetts Motor Vehicle Excise Tax Information.

If you own or lease a vehicle in Massachusetts you will pay an excise tax each year. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. You pay an excise instead of a personal property tax.

WE DO NOT ACCEPT. Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue date. Boat Excise Tax Motor Vehicle Excise Tax Personal Property Tax Real Estate Tax WaterSewer Fees.

If your vehicle is registered in. The excise rate is 25 per 1000 of your vehicles value. This information will lead you to The State.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. For Vehicles on the road. Payment at this point must be made through our Deputy Collector Kelley.

Excise Bills Motor vehicle and boat excise bills are issued on a calendar year basis. There will be a convenience fee associated with an online payment. Complete Edit or Print Tax Forms Instantly.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Drivers License Number Do not enter vehicle plate numbers. Find your bill using your license number and date of birth.

Motor Vehicle Excise. THIS FEE IS NON-REFUNDABLE. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

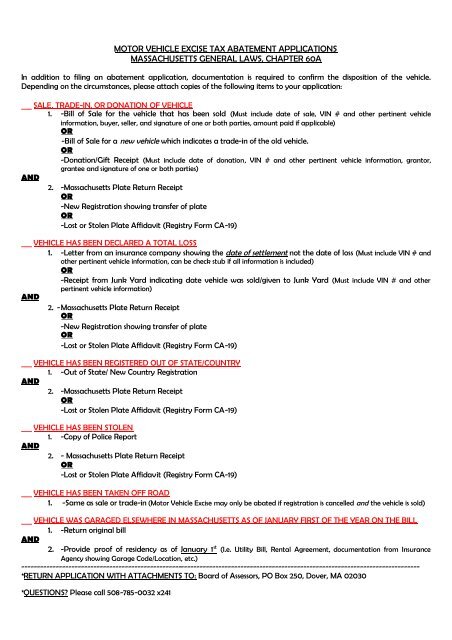

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Pay Delinquent Excise. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. Excise bills must show the date upon which the bills were issued and must contain the statement Due and Payable in Full Within 30 Days of Issue A. For payment of motor vehicle excise tax or a parking ticket please have your bill handy or know your plate.

781 294-7684 Contact Directory. If you are unable to find your bill try searching by bill type. The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle.

City Of Hartford Tax Bills Search Pay

Treasurer Collector News Announcements Plainville Ma

Motor Vehicle Excise Tax Bills Gardner Ma

Motor Vehicle Excise Information Methuen Ma

Motor Vehicle Excise Tax Plainville Ma

Motor Vehicle Excise Taxes Royalston Ma

Wtf Massachusetts R Massachusetts

2021 Motor Vehicle Excise Tax Bills Fairhavenma

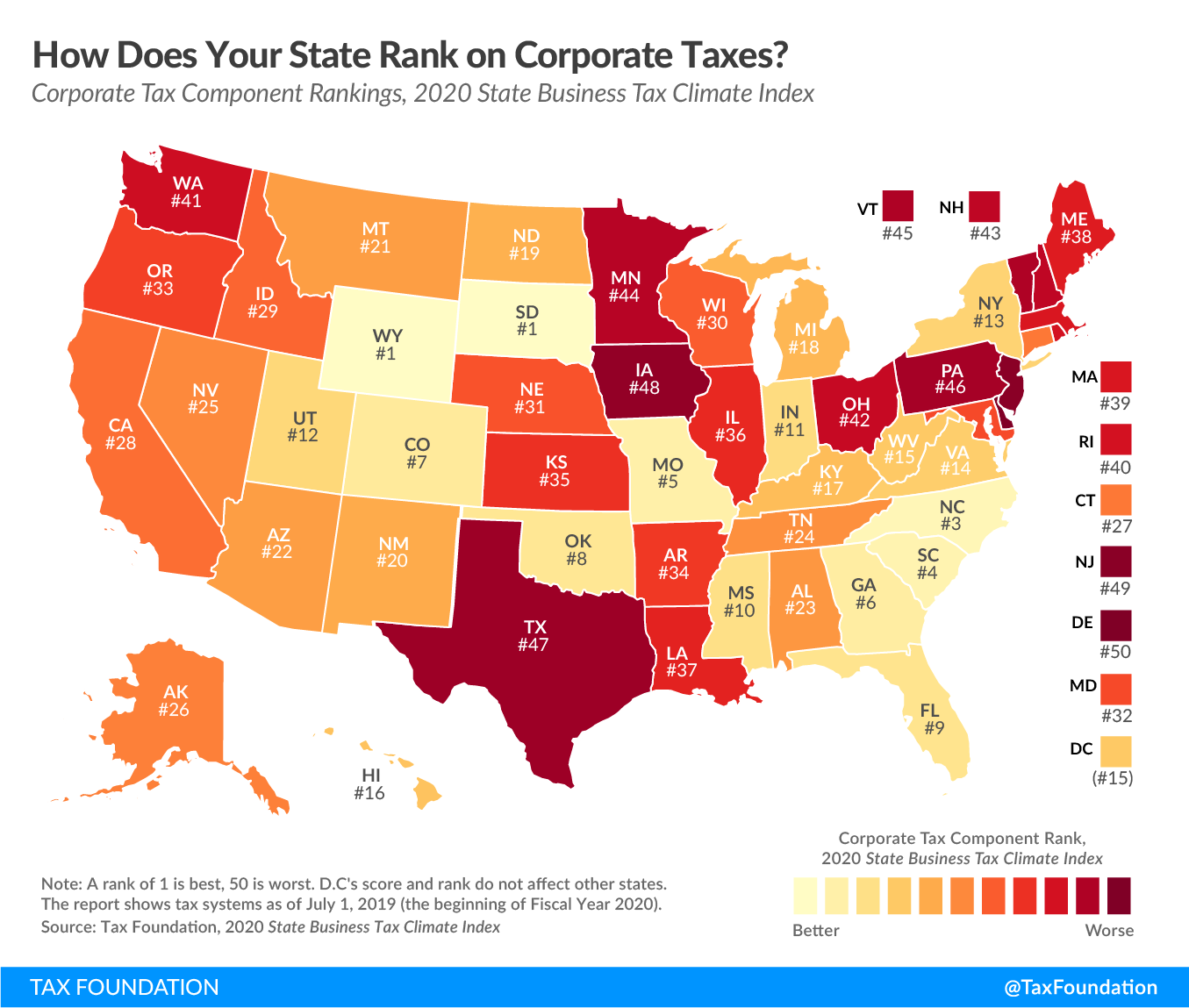

Massachusetts Corporate Excise Tax Should Be More Competitive

Motor Vehicle Excise Taxes Royalston Ma

Jeffery Jeffery Deputy Tax Collectors Massachusetts

Usa Finance And Payments News Summary 19 April As Usa

Search Results For Excise Tax City Of Revere Massachusetts

Online Bill Payment Town Of Dartmouth Ma

Motor Vehicle Excise Tax Abatement Applications Massachusetts